We will mail your reaction to your insurance provider to allow them recognize we need your insurance coverage records for the car. The second option is to finish the alert and mail it straight to our office. It is a service reply so there is no need for postage. I lost the DMV letter, what can I do? There are a number of choices to verify your insurance coverage.

I entered my insurance policy info online however it says "pending"? This indicates the insurance policy information you went into did not verify with your insurer's database instantly. It does not indicate you are not insured. If you just acquired a brand-new plan, it might take several days for the company to verify it.

If you believe the DMV has inaccurate details, please call NVLIVE The details on data can be looked into to validate if you are needed ahead into the workplace. Why did I get a qualified letter? A qualified letter is the alert of a feasible suspension. This might indicate we did not receive a response from the signed up owner within the (15) days response time or the insurance provider did not react to our notice within their (20) day response time.

If there is an actual gap in coverage, you will have to comply with the treatments under Reinstatements & Penalties. You may not legitimately drive the vehicle since the suspension date provided in the letter. insurance group. I received a letter that states "neglect" or "retracted". The "negligence" letter suggests your insurer has actually replied to the confirmation card sent out to you by verifying your insurance policy details.

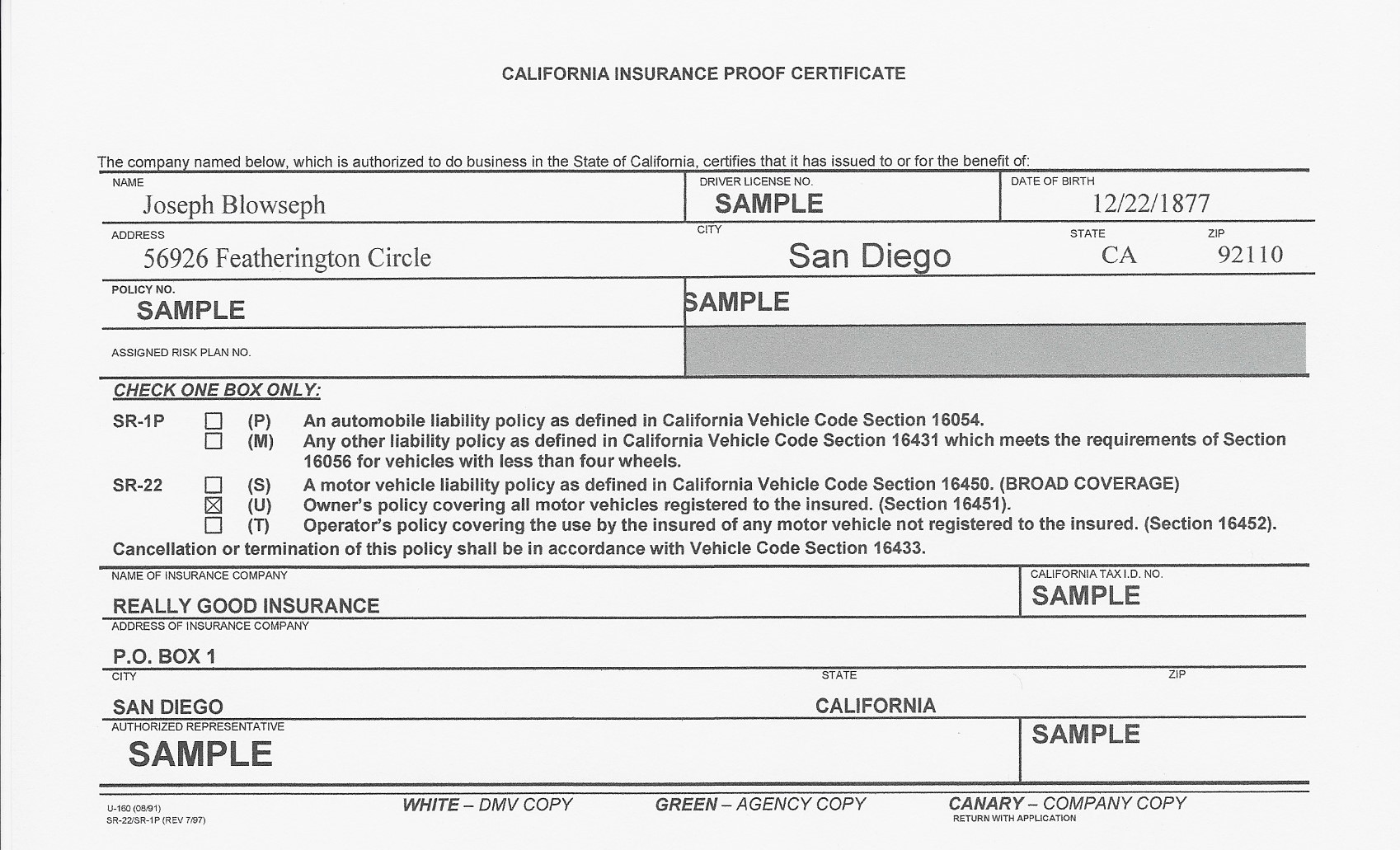

This implies your insurance coverage company confirmed coverage with the DMV, and also absolutely nothing even more is required. Just how does this relate to an insurance policy reinstatement? "SR-22 Insurance" is a Certificate of Financial Responsibility that your insurance coverage firm will certainly submit with the DMV.

The penalty for the gap of insurance coverage might still use. I will be car park my automobile and also might acquire "garage" insurance policy. Garage insurance policy is NOT obligation insurance coverage, as well as for that reason is not acceptable or reported to the DMV.

The 20-Second Trick For Financial Responsibility Insurance Certificates (Sr-22)

If you drop the liability insurance for any reason, you need to terminate the enrollment and surrender the permit plates. NVLIVE confirmation applies just to responsibility insurance. See Certificate Plate Give Up. Please contact your insurance representative to confirm whether you have liability insurance coverage. I'm having a disagreement with my insurance company/agent.

Have You had your chauffeur's permit put on hold or withdrawed? You may need an SR22 declaring prior to you can get your vehicle driver's certificate restored. What is An SR22? An SR22 is a just a state filing that is contributed to an insurance coverage. This filing allows thestate of SCknow that a person fulfills the demands to drive when traveling.

The SR22 filing is an accessory to the cars and truck insurance coverage policy. Some business might charge a simple filing fee for the SR22Some companies will bill an additional charge point system.

sr22 coverage liability insurance sr-22 insurance vehicle insurance insurance group

sr22 coverage liability insurance sr-22 insurance vehicle insurance insurance group

The judge orders a chauffeur to buy an SR22 Insurance plan when that vehicle driver has gotten a sentence for risky driving. A number of different violations might result in a court order for an SR22. These consist of: Driving While Intoxicated (DWI,) Driving Drunk (DUI,) driving without insurance coverage, or having an extreme variety of website traffic offenses in a brief period.

Some insurance coverage firms do not offer this kind of coverage, as it is regarded "high risk" insurance policy. Lots of regional insurance coverage representatives can recommend an agent that might function with risky clients.

insurance group sr22 insurance driver's license driver's license no-fault insurance

insurance group sr22 insurance driver's license driver's license no-fault insurance

For the individual who requires insurance coverage to remain on the roadway, this additional rate is extra than worth it. Some aspects that may play right into the ultimate rate of the plan normally include: The overall driving document of the motorist, both previously and after the sentence: If the conviction were an one-time point, the prices would certainly be lower.

Little Known Facts About What Is Sr22 Insurance Virginia? – Kalfus & Nachman.

The credit rating of the motorist: Greater credit rating scores will often produce a lot reduced rates, both with normal automobile insurance coverage and with SR22. The miles driven per month or year: The less miles, the lower the price will typically be. The place: Some locations of the united state have greater criminal offense prices, and also these areas usually have greater insurance policy prices also.

Marriage status: People who are wed typically get an added discount on their car insurance policy, as they are regarded to be a lot more mindful vehicle drivers – insurance.

The time is usually either 6 months or one year for average vehicle policies. SR22 functions in a different way because the court typically needs the certificate to be kept for numerous years.

The insurance coverage company is required by law to report any type of gaps in SR22 coverage to the state of South Carolina. This record, known as an SR-26, is filed with the state as well as the insurance holder will then lose their capability to drive. insurance coverage.

If an accident is triggered by the SR22-insured motorist as well as the minimum protection is not adequate to pay the damages, the insured person might undergo a suit from the individual who was hurt. South Carolina likewise requires all vehicle drivers to maintain evidence of insurance with them whatsoever times when behind the wheel.

Vehicle drivers with this kind of plan are strongly encouraged to maintain a copy of the insurance coverage in their glove area in all times. Last Upgraded on January 4, 2022 by Lauren Mckenzie. underinsured.

The smart Trick of Do You Need Sr-22 Insurance After A Dui? – Intoxalock That Nobody is Talking About

Any Colorado homeowner that has actually had their vehicle driver's certificate withdrawed for driving drunk is called for by the Division of Earnings, Division of Electric Motor Automobiles (DMV) to obtain "Proof of Insurance policy" prior to reinstatement of their driving advantages. This type of insurance, referred to as an SR-22, requires the insurance policy provider to report any type of lapse in insurance protection to the Colorado Automobile Division.

The insurance coverage firm assures the DMV it will certainly give notice to the DMV of termination in the occasion of premium non-payment. SR-22s are required for license suspensions or revocations. DUIs, Driving without insurance, Repeat traffic offenses, etc (insurance).

auto insurance ignition interlock sr22 coverage auto insurance underinsured

auto insurance ignition interlock sr22 coverage auto insurance underinsured

If you allow your policy to lapse or you cancel it, your automobile insurance coverage company is needed to alert the state promptly as well as your certificate will be withdrawed or put on hold once again. SR-22s are state particular.

If you presently bring an SR-22 as well as relocate to a state that that does not require an SR-22, you still need to appropriately meet the needs of the SR-22 in the state it was originally released in. In addition, your new insurance policy have to have responsibility restrictions which meet the minimums called for by regulation in your former state.

Exactly how do I acquire SR-22? You must call your insurance company to get an SR-22 (bureau of motor vehicles). If your insurance provider does not use SR-22 or is going to cancel your protection as a result of this requirement, you can call Sarah or Dane Hamilton at HL Insurance Coverage Group at (720) 343-7459, as they provide SR-22 and also all of your various other insurance policy needs at affordable prices.

You should contact your insurer as well as a number of other insurer to get a quote. SR-22 is relatively inexpensive; nonetheless, SR-22 is a warning to your insurance policy supplier that you have issues with your driving history and also are now a high threat loss. Asking for as well as obtaining SR-22 allows your insurer recognize something is happening with your driving history and also urges the insurer to check out additionally right into why you are being required to have an SR-22. liability insurance.

An Unbiased View of Future Financial Responsibility – Adot

This information is what triggers the insurance policy firm to dramatically elevate your prices as they now identify you as high risk. car insurance.

Obtain in touch with your insurance policy company to discover out your state's existing demands as well as make sure you have adequate insurance coverage. Just how long do you need an SR-22? The majority of states need drivers to have an SR-22to prove they have insurancefor regarding 3 years.

Any kind of lorry with a present Florida registration must: be guaranteed with PIP as well as PDL insurance at the time of automobile enrollment – bureau of motor vehicles. have a Cars signed up as taxis should lug bodily injury liability (BIL) coverage of $125,000 each, $250,000 per event and $50,000 for (PDL) coverage. have continuous protection also if the vehicle is not being driven or is inoperable.

You must get the registration certificate and permit plate within 10 days after starting work or registration – underinsured. You should likewise have a Florida certificate of title for your car unless an out-of-state lien holder/lessor holds the title as well as will not release it to Florida. Vacating State Do not cancel your Florida insurance policy until you have actually registered your automobile(s) in the various other state or have actually given up all legitimate plates/registrations to a Florida.

underinsured sr22 insurance division of motor vehicles sr22 insurance vehicle insurance

underinsured sr22 insurance division of motor vehicles sr22 insurance vehicle insurance

Fines You should preserve required insurance policy protection throughout the registration period or your driving benefit and also certificate plate may be put on hold for up to three years. There are no stipulations for a short-lived or difficulty driver license for insurance-related suspensions (insurance group). Failing to keep necessary insurance protection in Florida might result in the suspension of your driver license/registration and also a requirement to pay a reinstatement cost of approximately $500.

occurs when an at-fault party is taken legal action against in a civil court for problems created in an automobile accident as well as has not completely satisfied residential or commercial property damage and/or physical injury demands. (PIP) covers you despite whether you are at-fault in a collision, as much as the limitations of your plan. no-fault insurance. (PDL) spends for the damage to various other people's building.

How How Long Do You Have To Keep An Sr-22? – Auto Insurance … can Save You Time, Stress, and Money.

underinsured insurance group department of motor vehicles ignition interlock underinsured

underinsured insurance group department of motor vehicles ignition interlock underinsured

A sentence for a Louisiana Dui can Visit website result in the suspension of your driving opportunities for a year or even more on your very first violation. In order to reinstate your driving privileges, you might be needed to finish a motorist education training course, pay significant penalties of $100.

SR-22 insurance is needed for 2 years following the most recent suspension. Also if the individual forgoes getting a work authorization, SR-22 insurance is still needed for two years from the day their license is renewed. If SR-22 insurance policy is gotten and submitted with the Iowa Division of Transportation, after that the certificate plate and also enrollment abandonment arrangements do not put on that lorry.